Talks aimed at cooling tensions between the US and China have ended in a “deal”, according to US President Donald Trump.

He said China had agreed to supply US companies with magnets and rare earth metals, while the US would walk back its threats to revoke visas of Chinese students.

“Our deal with China is done, subject to final approval from President Xi and me,” Trump wrote his media platform Truth Social.

It followed two days of intense talks in London to resolve conflicts that had emerged since the two sides agreed a truce in May, after a rapid escalation of tariffs had nearly paralysed trade between the world’s two largest economies.

Last week, Trump and China’s leader Xi Jinping spoke over the phone to kickstart the negotiations, which involved top officials from both countries.

Details about the new agreement were limited. But officials said it would not alter the broad outlines of the May truce, which had lowered – but not eliminated – new tariffs announced by the two countries since Trump launched a new trade war earlier this year.

“The two sides have, in principle, reached a framework for implementing the consensus reached by the two heads of state during the phone call on 5 June and the consensus reached at the Geneva meeting,” China’s Vice Commerce Minister Li Chenggang said.

US Commerce Secretary Howard Lutnick told reporters the two sides had “reached a framework to implement the Geneva consensus”.

“Once the presidents approve it, we will then seek to implement it,” he added.

Speaking to broadcaster CNBC on Wednesday, he said the talks had “cleaned up” the Geneva agreement.

“We’re totally on the right track,” he said. “Things feel really good.”

The negotiations in London were triggered in part by US concerns that China was being too slow to release exports of its magnets and rare earth minerals, which are essential for manufacturing everything from smartphones to electric vehicles.

Beijing in turn has criticised controls the US has put in place to limit the country’s access to semiconductors and other related technologies linked to artificial intelligence (AI) and the Trump administration’s plans to limit visas for Chinese students.

Speaking to CNBC, Lutnick said the US had agreed to remove some “counter-measures” without being specific about the response.

Treasury Secretary Scott Bessent, who was testifying before Congress on Wednesday, said the recent talks had been narrowly focused and a more comprehensive deal would take time.

“It will be a much longer process,” he said.

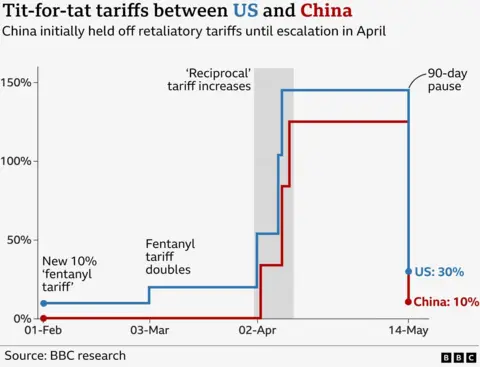

When Trump announced sweeping tariffs on imports from a number of countries earlier this year, China was the hardest hit.

China responded with its own higher rates on US imports, triggering further tit-for-tat increases.

In May, talks held in Switzerland led to a temporary truce that Trump called a “total reset”.

It brought Trump’s new US tariffs on Chinese products down from 145% to 30%, while Beijing slashed levies on US imports to 10% and promised to lift barriers on critical mineral exports. It gave both sides a 90-day deadline to try to reach a trade deal.

But the US and China subsequently claimed breaches on non-tariff pledges.

In his social media post, Trump said the US would have tariffs on Chinese goods of 55%, but officials said the figure included tariffs put in place during his first term.

Markets showed little response to the deal, which Terry Haines, founder of the Washington-based consultancy Pangaea Policy, described as having both “very limited scope and unfinished status”.

“Setting the Geneva ‘pause’ back on track is the smallest of accomplishments, and doesn’t suggest that a broad US-China trade deal or geopolitical rapprochement is any closer in the foreseeable future,” he wrote.